CFA designates an international professional certificate that is offered by CFA Institute. CFA charterholders have in-depth knowledge of types of securities, investment analysis, and investment decision making. In order to qualify for a CFA charter, candidates must meet standards for examination, work experience, and ethics.

EXAMINATION: Candidates must pass a series of three rigorous CFA exams (Level I, Level II, and Level III) covering topics such as ethics, quantitative methods, economics, corporate finance, financial reporting and analysis, security analysis, and portfolio management.

WORK EXPERIENCE: Candidates must have completed at least 4,000 hours of relevant work experience in a minimum of 36 months. Qualified hours must be directly related to the investment decision-making process or producing a work product that informs or adds value to that process.

ETHICS: As a CFA Institute member, candidates and charterholders must adhere to the strict CFA Institute Code of Ethics and Standards of Professional Conduct, as reviewed by CFA Institute.

To learn more about the CFA designation, please go to the CFA Institute website at  https://www.cfainstitute.org/.

https://www.cfainstitute.org/.

An effective way for investors to think about those with careers in personal finance is to separate professional money managers from asset gatherers. Banyan Asset Management, Inc. proudly distinguishes itself from competitors with its roots firmly planted in the principles of professional money management.

Professional money managers perform their own proprietary research on investment possibilities and make investment decisions by marrying the results of their research with the objectives and risk profiles of their individual clients.

Asset gatherers are sales people who are focused on selling financial products. While they may come across as financial "experts", surprisingly they are not. Once they sell you their products and generate commissions for themselves, they are off to the next sales event to find more clients (i.e., to gather more assets).

CAUTION: Asset gatherers rarely admit that they are asset gatherers, and they often try to masquerade as professional money managers.

Registered Investment Advisor firms have a fiduciary duty to act in the best interest of their clients. Banyan Asset Management, Inc. is registered in Florida and Michigan.

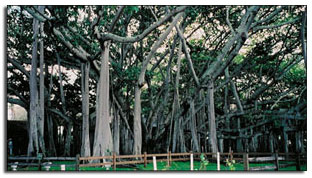

The "Banyan" name comes from the banyan tree (ficus bengalensis), the national tree of India. In 1925, Thomas Edison was given a small banyan tree by Harvey Firestone as a gift of goodwill and to help promote Edison's search for a high yield rubber source. Edison planted the tree outside of his laboratory at his Fort Myers, Florida winter estate. The tree thrived in the tropical climate of southwest Florida and grew into the third largest banyan tree in the world (pictured on this page).

One of the tree's unique characteristics is its phenomenal ability to grow multiple trunks. From the branches that grow from the original tree trunk, aerial whisker-like roots hang down. When these aerial roots eventually reach the ground, they attach to the soil and take in more nutrients. Steadily, the roots thicken and grow into additional tree trunks. Because of its multiple trunks, the banyan tree is known in India as the Many Footed One. The massive banyan tree on the Edison estate is limited only by the property on which it grows. It is so large that it has to be trimmed on a periodic basis to curtail growth beyond property limits.

The symbolism locked inside of the banyan tree is profound, particularly with respect to the financial markets. It is easy to topple a tree with only one trunk, but how do you chop down a banyan tree? Even if the original trunk is completely severed, the other trunks will continue to hold the tree firmly in place. In finance, this is diversification. Any one investment may turn sour; but, if other investments are properly diversified, the entire portfolio will not be destroyed by the one bad investment. Diversification, with tree trunks and with investments, is the foundation for stability.

In addition to being stable, the banyan tree grows "exponentially" (arithmetic growth is "1-2-3-4-5", whereas exponential growth is "1-2-4-8-16"). As more trunks develop, the tree has more opportunity to grow additional aerial roots and thus create even more trunks. The bigger the tree gets, the faster it grows. In finance, this is compound interest. Compound interest means that interest is earned on interest. The more money one has, the faster it is able to grow in absolute terms (assuming a positive return is earned).